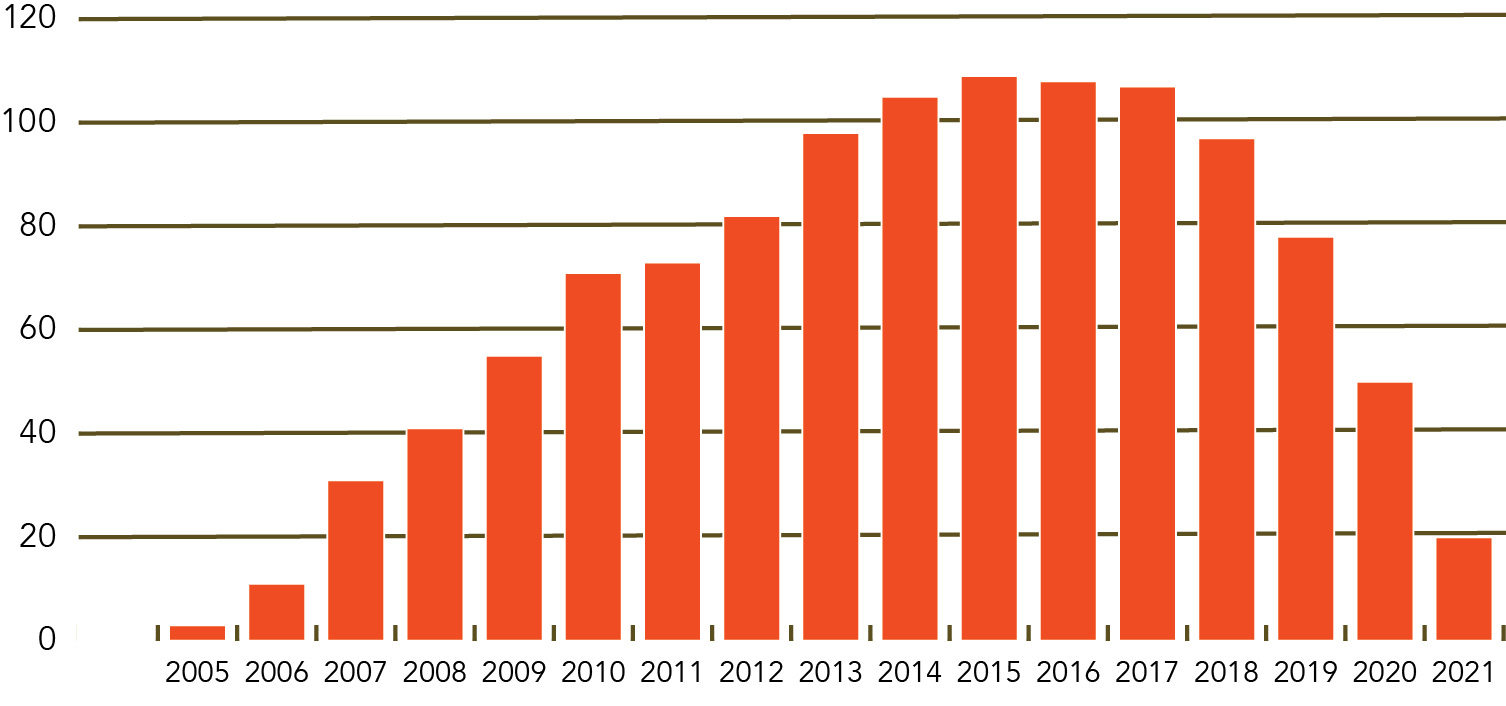

Huawei's Erstwhile Revenue Trajectory Shows Reversal Amid US Sanctions

October 29, 2022

© Benzinga Huawei Technologies Co. Given by In the third quarter it reported revenue growth for the second straight quarter, reflecting signs of stabilization after a multi-year US ban on sales of its telecommunications equipment. The Wall Street Journal reported that the Chinese telecom giant's revenue rose 6.5% to 144.2 billion yuan, or $20 billion, in the third quarter from a year ago. Also Read: US-China tensions rise after Taiwan's TSMC Huawei, NVidia, AMD drop to long-term slowdown in consumer equipment business after increased mainline telecom equipment sales The results reflect a year-over-year decline in revenue due to lower smartphone sales and restrictions on telecom equipment sales. The US ban has crippled the company's smartphone business, a major source of its revenue. It also hurt its telecommunications equipment business. The report added that Huawei is developing several new lines of business that are less dependent on chips, such as cloud computing services, autonomous driving components, smartphone software and consumer equipment such as smart watches and tablets. However, the new jobs couldn't make up for the sharp decline in smartphone sales. Huawei has invested heavily in China's fast-growing chip industry through its investment arm Hubble Technology Investment Co. The U.S. has long viewed Huawei as a national security threat and has said Beijing could use the Huawei team to spy on it, which the company denies. Huawei is selling to several companies, including budget smartphone brand Honor, to get around restrictions on access to chips. Huawei plans to relaunch 5G phones by 2022 to avoid US sanctions and regain market share. Huawei is redesigning its phones to use the Chinese company's less advanced chips that will enable 5G. In September, Huawei launched its latest satellite-enabled flagship smartphone ahead of Apple Inc (NASDAQ: AAPL ) and Samsung Electronics Co, Ltd (OTC: SSNLF ). Price Action: AAPL shares closed 3.05% lower Thursday at $144.80.

© Benzinga Huawei Technologies Co. Given by In the third quarter it reported revenue growth for the second straight quarter, reflecting signs of stabilization after a multi-year US ban on sales of its telecommunications equipment. The Wall Street Journal reported that the Chinese telecom giant's revenue rose 6.5% to 144.2 billion yuan, or $20 billion, in the third quarter from a year ago. Also Read: US-China tensions rise after Taiwan's TSMC Huawei, NVidia, AMD drop to long-term slowdown in consumer equipment business after increased mainline telecom equipment sales The results reflect a year-over-year decline in revenue due to lower smartphone sales and restrictions on telecom equipment sales. The US ban has crippled the company's smartphone business, a major source of its revenue. It also hurt its telecommunications equipment business. The report added that Huawei is developing several new lines of business that are less dependent on chips, such as cloud computing services, autonomous driving components, smartphone software and consumer equipment such as smart watches and tablets. However, the new jobs couldn't make up for the sharp decline in smartphone sales. Huawei has invested heavily in China's fast-growing chip industry through its investment arm Hubble Technology Investment Co. The U.S. has long viewed Huawei as a national security threat and has said Beijing could use the Huawei team to spy on it, which the company denies. Huawei is selling to several companies, including budget smartphone brand Honor, to get around restrictions on access to chips. Huawei plans to relaunch 5G phones by 2022 to avoid US sanctions and regain market share. Huawei is redesigning its phones to use the Chinese company's less advanced chips that will enable 5G. In September, Huawei launched its latest satellite-enabled flagship smartphone ahead of Apple Inc (NASDAQ: AAPL ) and Samsung Electronics Co, Ltd (OTC: SSNLF ). Price Action: AAPL shares closed 3.05% lower Thursday at $144.80.© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trending: Garry Kasparov calls Rishi Sunak's first phone call as British prime minister "leader of the free world".

Must Read: US markets end week on a wave, with Amazon dips for Nasdaq futures; Focus on Apple, Pinterest, oil giants and inflation statistics