Everything You Wanted To Know About Ethereum But Were Too Afraid To Ask

I've lost count of how many people have asked me to explain what Bitcoin is over the years, but I don't think anyone has ever asked me to explain Ethereum.

Maybe they wanted to escape because they got tired when I ran out of bitcoins.

But today we ask: What is Ether?

If you think bitcoin is hard to explain…

A brief history of Ethereum and Vitalik Buterin, its founderAs of 2018, Ethereum is the second largest cryptocurrency by market capitalization. It's the brainchild of Russian-Canadian programmer Vitalik Buterin, who first proposed the idea in a 2013 White Paper.

At this point, Buterin has been a Bitcoin for several years. He was first introduced to Bitcoin by his father, a computer scientist. In 2011, at age 17, he was still in college (a recent dropout). Later that year, he found Bitcoin magazine.

Lest you feel like you can't handle it, Buterin is only 27 years old and a multi-billionaire — he's donated more than $2 billion to charity on several occasions.

Philosophically, Buterin is a fairly hard-line techno-libertarian. In 2018, he co-authored an article with economist Glenn Weil titled "The Radical Decentralization of Freedom," in which he proposed "using markets and technology to decentralize all forms of power and shift our dependence on government."

In his 2019 paper, "Flexible Design for Financing Public Goods," he co-authored with Harvard PhD student Zoe Hitzig a new method for optimal delivery of public goods and services using "square voting"—a more sophisticated voting system than the current representative. allows for direct democracy.

Buterin published the Ethereum White Paper in 2013. He chose the name after coming across a list of ingredients on Wikipedia. “It looks amazing and contains the word 'aether', a hypothetical invisible medium that permeates the universe and allows light to pass through it.

He announced the project at the North American Bitcoin Conference in 2014 and development began with a versatile founding team that included Anthony D'Iorio, Charles Hoskinson (co-founder of Cardano), Mihai Aliz and Amir Cherit, soon followed by Joseph Lubin, Gavin Wood. and Geoffrey Wilke.

They funded the project that summer. At the time, Buterin was considered a prodigy in crypto circles.

I remember being asked to help with funding, but I was annoyed by the poor project description, so I didn't go any further. Oh!

The project finally got off the ground in 2015, and after going public for $150 million, it faced a few obstacles, including a $50 million hack and several forks, but the project should be considered a resounding success.

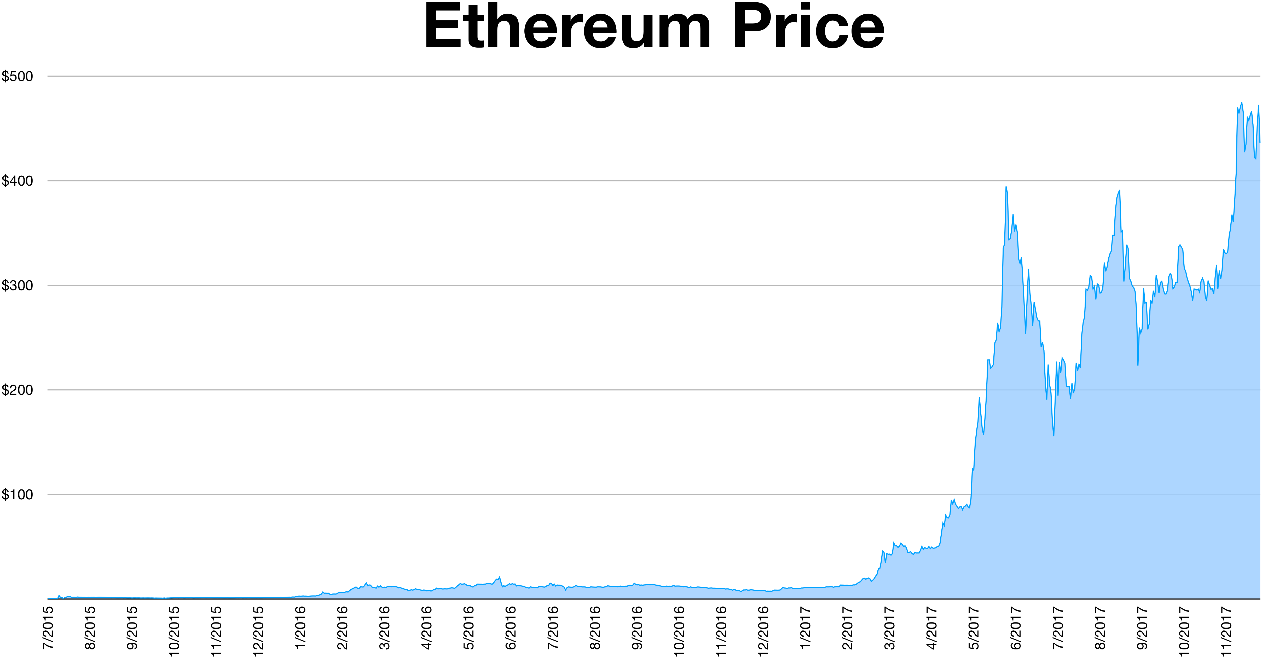

Ethereum has a market cap of around $400 billion. Ether, which changes hands on the Ethereum network, has risen from less than $1 in late 2015 to $3,500 today.

What is Ethereum?The basic principle of this project is to use blockchain technology for purposes other than alternative digital money systems. Bitcoin has its own blockchain, just like Ethereum - a completely separate network that uses the same distributed ledger technology to verify and record transactions (blockchain).

Like most cryptocurrencies, Ethereum is an open source platform. Ether is used and accepted as a form of payment, but that's not really what Ethereum is.

Byte Tree's Charlie Morris likens it to a decentralized app store. Developers can use the platform to create and publish smart contracts and distributed applications (dApps), and it is a marketplace for payments for financial services (Diff), NFT (Non-tradable Tokens), games and applications. For the air.

That is why it is known as the “Global Blockchain Program”. According to him, it is "modifiable, decentralized, secure and with it you can change anything".

Thus, coders can deploy decentralized applications on the Ethereum blockchain. It will be immutable and persistent, and the user will be able to interact with it.

Decentralized financial (DeFi) applications offer all kinds of financial services – such as decentralized money exchanges or credit and loan systems – that do not require traditional financial intermediaries such as banks or brokers.

Ethereum allows the creation and trading of NFTs - tokens linked to digital artwork and other digital assets.

Many use the platform for initial coin offerings, and many cryptocurrencies currently run on the Ethereum blockchain (they are known as ERC-20 tokens). DAOs - Digital Autonomous Organizations - are taking shape on the platform.

So, overall, Ethereum has found many uses and has become a great medium to play with the amazing innovations happening in the industry.

Will Ethereum lose out to its competitors?One of my close "real hacker" Bitcoin friends, who prefers to remain anonymous on the matter, has always told me, "Ethereum must fail and why it won't is a mystery to me."

Many feel the same way. Blockchain is not as powerful as Bitcoin; Ethereum is properly decentralized, and the many forks that have occurred in response to the hack are proof that critics say it cannot be on a properly decentralized platform. Many coins are pre-mined and distributed to founders. Ethereum 2.0 has had delays. The transaction fees, called gas fees, are very high (I can vouch for that). Sometimes he spends several hundred dollars when he should spend a dime. It's a ticking time bomb, critics say.

It's possible. Ethereum has many competitors - Binance Smart Chain, Polkadot, Cardano, Terra and Solana for example. Both Cardano and Solana have made impressive appearances, the latter only coming in recent weeks. Most of them are technological, reviewers are faster, more powerful. They certainly don't have inflated gas costs.

But one thing they don't have is user networks. It also has Ethereum. It's the first currency people think of after Bitcoin, even if they don't know how to pronounce it correctly. This is usually the advantage you get first.

But this is the market. Everyone bets, expresses his opinion and the prize is the result. The best man doesn't always win.

Ethereum is second only to Bitcoin. It was a great year after some great years. It's like bitcoin cash in gold - it's more volatile except it has more leverage. It usually moves later in the cycle, but more, but when a correction comes, it is more tangible.

At the end of 2015, it was trading at $0.42. The price reached $1,400 in early 2017. Then it lost 95% of its value and fell to $80. This year's correction is more than 60% off. But the bottom line is that in 2021, it started at less than $800, and has now quadrupled to $3,500.

Direction is up. But how many more?

Robbery of the Day - How Taxes Shape the Past and Change the Future is now available in paperback from Amazon and all good audiobook bookstores, Dominick, Audible and elsewhere.